Isn't that what the lefties, libs and Dems keep claiming? Isn't that what MSNBC is telling them to say and believe?

That's weird, because this sure seems like Biden is trying to impact gas prices......

www.nytimes.com

www.nytimes.com

(silly libs, Trix are for kids)

That's weird, because this sure seems like Biden is trying to impact gas prices......

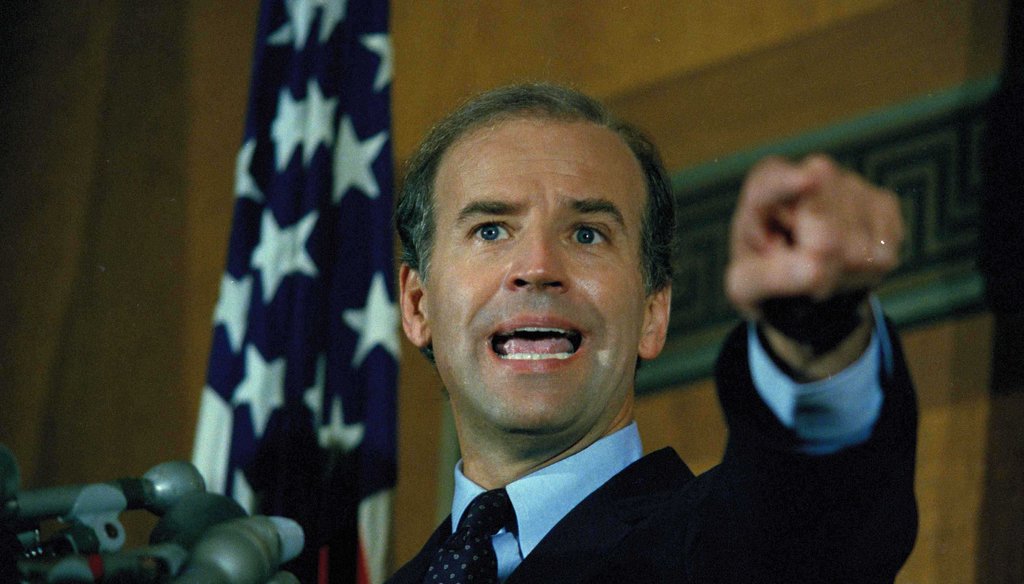

Biden Says He Is Considering Seeking a Gas Tax Holiday

With regular gasoline around $5 per gallon, suspending the federal gas tax would provide a measure of relief for consumers, but Congress would need to take action.

(silly libs, Trix are for kids)